You may be concerned about a drop in lead flow during tough economic times, yet the right insurance lead generation techniques can keep you on track.

Our economy fluctuates between periods of growth and recession. With interest rates rising and inflation climbing, the prosperous times we have enjoyed the past several years are starting to give way to uncertainty. To compound matters for consumers even more, we have had to contend with a worldwide pandemic and worry concerning a war overseas.

Consumers have a lot on their minds. While none of these issues are directly related to insurance sales, they have an impact on how insurance prospects think. Concerns about security for the future are front and center during difficult economic times. People are more interested than ever in protecting their assets and the people they love, and that makes them more receptive to talking about insurance.

We are providing some distinct insurance lead generation techniques you can implement starting today during these hard economic times we are facing.

Set Up a Website or Reinvigorate Your Existing Site

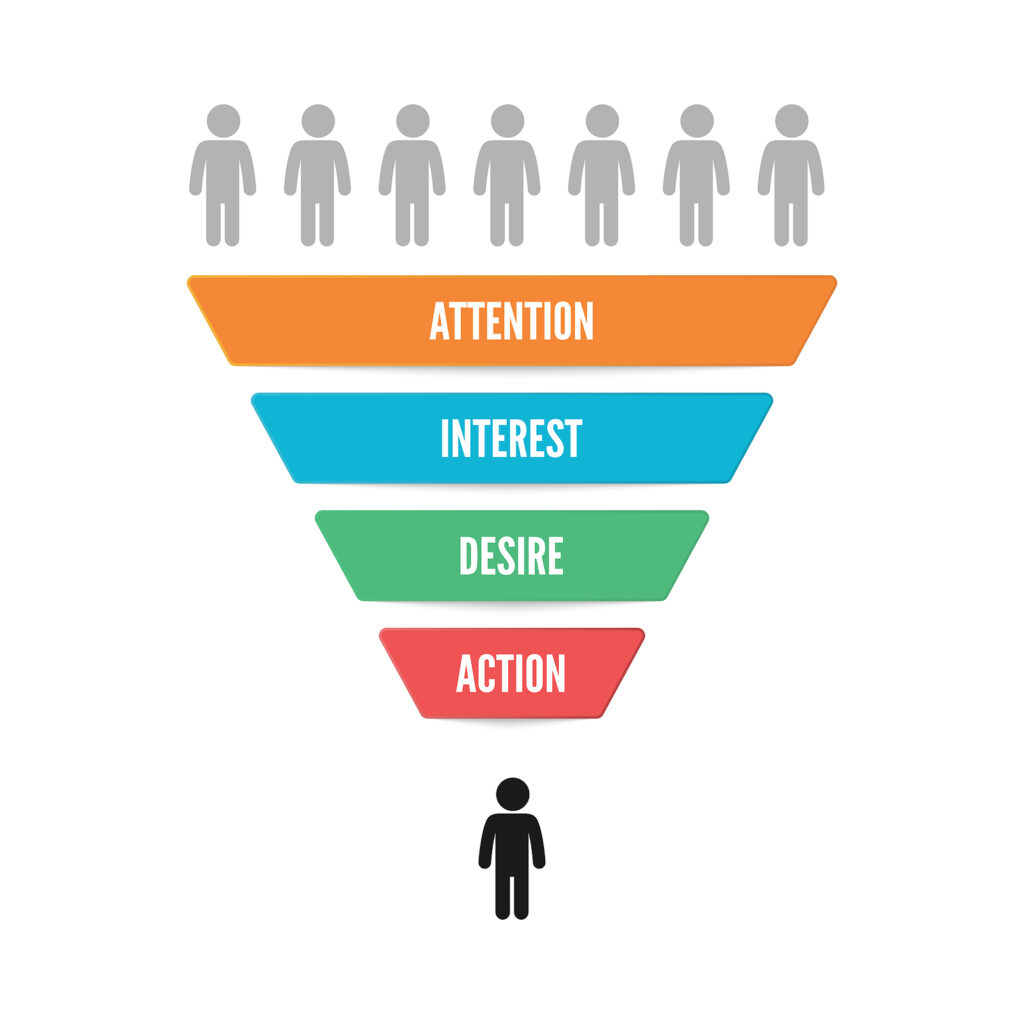

A functional, informative website draws customers to your agency. This is important because thousands of prospects are browsing the web every day looking for insurance. By having a visible presence online and using effective insurance lead generation techniques, you can generate higher numbers of leads. The better your lead generation techniques, the more opportunities you have to schedule appointments with people who are interested in the insurance products you offer. You can consider these to be qualified leads, also known as warm leads.

A well-planned website is the foundation of your lead generation efforts. An eye-catching professional website gives prospects a great first impression. It helps you build credibility and authority, as well as establish trust, both of which are good steps toward building a book of loyal customers. An engaging website will also set you apart from the competition.

Additionally, your website is a place where you can post positive reviews and testimonials from satisfied customers to build trust even more.

At first glance, your customers will learn who you are and what your brand is about. Your site tells prospects what kinds of insurance you offer and how those products can better their lives.

Moreover, people like to read about interesting things, and there are a lot of noteworthy facts to learn about insurance. By adding a link to your blog on your website, prospects will return again and again, each time enabling you to learn more about who they are and what they need. A blog also gives you opportunities to speak publicly about any issues and concerns keeping them up at night.

Optimize your website and strive to get it listed as high as possible in the search results of the most popular search engines. An eCommerce Foundation study showed about 88% of consumers research products online before they go to a brick-and-mortar store to make a purchase. Furthermore, a highly functional website enables you to generate leads around the clock.

Change Your Narrative About the Economy

Most of us have a tendency to form a narrative about the economy based on what we hear in the media. Having noted the news is inherently negative, it has not gone unnoticed by the leads you are contacting. While you have no control over the economy, you do have control over how you think and talk about it with prospects.

There is a popular saying in the media dating back to the 1890s saying, “If it bleeds, it leads…” Essentially, it means alarming news gets attention. Readers and viewers want to know what threats are developing that may impact their lives.

Contrary to the belief that negative economic trends prohibit consumers from buying, an economic downturn can actually present good opportunities for insurance lead generation. Why? Because it allows you to modify your sales pitches to answer the biggest challenges and potential threats prospects are facing. In this way, prospects learn how insurance can actually protect them better and possibly even save them money in the process.

Be aware that sales cycles will likely be longer than normal during hard economic times. People tend to give more thought to their financial decisions when times are tenuous.

Overall, insurance agents and brokers who are patient and persistent will get the best results regardless of what is happening with the economy.

Tough Times Call For Deepening Relationships & Improved Insurance Lead Generation Techniques

Everyone needs insurance, even in a recession. When economic times are challenging, people are looking to get the best value for their insurance.

Regardless of your prospect’s financial status, nearly everyone is affected by the economy. To successfully generate leads, you have to be willing to step into their shoes. Ask yourself what types of things are causing them to be interested in your products, but not willing to pull the trigger.

Have they been directly hit by the economy in some way? Are they having issues related to supply chains? Are they more concerned about life insurance because of worry over viruses that are spreading globally? Are they under heavy pressure to curtail their budgets?

These and other issues create pressure on your prospects that you may not be aware of – unless you build a relationship with them over time and they feel comfortable enough to share pertinent information.

Even if people are not being directly impacted by the economy, they are likely suffering from doubt, fear, and uncertainty. These worries play a role in how responsive they are to your interactions with them.

Make it a point to get to know the leads you are contacting, and strive to create deeper relationships with them. During your conversations with prospects, show them you care about what is important in their lives.

Insurance Lead Generation Techniques: Actionable Steps

Beyond having an engaging website, changing the narrative about the economy, and building better relationships, we will give you three actionable steps you can implement to keep your pipeline of leads flowing despite economic ups and downs.

- Set up Google alerts. Take note of the concerns your customers share with you during interactions. Which of their concerns impact their insurance decisions? If one prospect expresses a particular issue, others likely have the same ones. Set up a Google alert on each of those issues and Google will notify you automatically any time relevant keywords appear on the internet. You can also set up Google alerts on insurance topics and insurance companies.

As articles come to your inbox, it frees up your time and energy for prospecting and delivering customer service. Greater knowledge gives you many talking points.

- Plug time into your schedule for relationship building. Schedule time for relationship building on the same day of the week and dedicate a certain number of minutes or hours to it. For example, you might set a goal of increasing sales activities by 5% or 10%.

Before calling on customers, check with customer service or review details in your CRM to see if they have had any complaints or issues with your agency or an insurance company. This way, you will not be blind-sighted if they mention a problem.

Also, find out what clients like about your agency or the insurance companies you represent. Highlight the things people like about insurance and share positive, inspiring stories.

Find out how your clients’ lives and jobs are going. Millions of people quit their jobs during the Great Resignation, and that could impact their insurance needs.

- Make changes to your website. If you do not have a website, Easy Insurance Pro can help you put a site up quickly to start producing leads fast.

An insurance website should make it easy for visitors to navigate without getting lost on your pages. Keep your links and tabs simple, and clearly label them. Your site should organically lead them to an online contact form.

Create an attractive design that will appeal to all ages. Use colors and images that speak to your brand.

Post helpful content regularly. Write in terms the general public can understand, and be sure to explain any difficult insurance concepts. Also, structure your content so it is search engine optimized. Add keywords to your content that prospects are likely to put into the search engine box so your site will pull up more easily.

Also, be sure your site loads quickly to ensure visitors have a good user experience. For instance, prospects will leave sites quickly when they have to wait too long for a site to load.

These steps are simple to do, and the effort you put into them will be well worth your time.

Final Thoughts

The insurance industry goes through cycles of hard and soft markets. Successful insurance agents modify their insurance lead generation techniques based on how prospects respond to marketing efforts. A little experimenting will show you what works and what does not.

Keep the proper perspective and focus on solutions no matter what the economy dishes out. During the current tough economic times, prospects will be most concerned about safety and security. Those things play right into everyone’s insurance needs.

At Easy Insurance Pro, we have the tools to help you succeed with website building and insurance lead generation techniques. Contact us at 800-327-6623 to learn how to design effective websites and landing pages to drive healthy leads to your inbox today.